1031 Exchange Investment Strategies

Invest alongside leading institutional firms to complete your 1031 exchange. Access Delaware Statutory Trusts (DSTs), 721 Exchange REITs, oil & gas royalties, and custom exchange solutions — all designed for accredited real estate investors.

$4 Trillion+ AUM

Our platform’s institutional investment sponsors manage more than $4 trillion of investor capital.

250,000 Investors

Baker 1031 Investments has educated and transacted with over 250,000 real estate investors.

20.28% Annual Returns

The investment sponsors on our platform have averaged a 20.28% net annual return.

Trusted by 30%

Baker 1031 Investments is the investment firm of choice for nearly 30% of real estate investors.

How It Works

Getting started with Baker 1031 Investments takes less than 5 minutes.

Tell Us About Your Exchange

Share your 1031 exchange details and investment goals. We help you understand your options.

Review Curated Investments

We match you with pre-vetted options from leading institutional sponsors that fit your exchange.

Close Your Exchange

Complete your 1031 exchange — often in 1 to 3 business days — and start receiving passive income.

Delaware Statutory Trust (DST) Properties

A Delaware Statutory Trust (DST) is a legal entity formed under Delaware law that holds title to real estate and allows multiple investors to own fractional interests in institutional-grade properties.

A Delaware Statutory Trust (DST) lets accredited investors complete a 1031 exchange while moving into a fully passive investment. DSTs are ideal for investors who want a stable monthly income without the burdens of property management.

With a DST, you own a share of a diversified portfolio of income-producing real estate. The properties are managed by institutional firms on your behalf. The DST structure is designed to shield owners from personal liability. Investors receive their portion of rental income, tax deductions, long-term growth potential, and estate planning benefits.

The Shoppes at Crystals • Las Vegas, NV • Owned by Invesco

How DST Ownership Works

When you invest in a DST, you purchase a beneficial interest in the trust. The DST holds title to one or more income-producing properties — such as apartment communities, industrial warehouses, medical offices, or retail centers. An institutional sponsor manages the property on behalf of all investors.

As a DST investor, you receive your share of the rental income as monthly distributions. You also receive the tax benefits of real estate ownership, including depreciation deductions that can shelter some or all of your income. Because the DST is a pass-through entity, these deductions flow directly to your personal tax return.

Who Should Consider a DST?

DSTs are designed for accredited investors who want to:

Defer capital gains taxes through a 1031 exchange

Move from active property management to a fully passive investment

Diversify across property types and geographic locations

Access institutional-grade real estate, typically reserved for large investors

Simplify estate planning with easily divisible ownership interests

Key Benefits of DSTs for 1031 Exchanges

Can Be Diversified Across Multiple Properties or Portfolios

Limited Liability and Non-Recourse Financing (If Debt is Needed)

Can be Diversified Across the Nation and by Asset Class

Investors Can Close Escrow in as Few as 1-3 days

Structured to Provide Stable Monthly Income

Multiple Exit Options Including Access to a REIT

Investment Amount Customized to Fit Exactly What is Needed

Structured to Avoid the Burdens of Management

World Trade Center • New York, NY • Owned by Silverstein Properties

1031 Exchange into a REIT via 721 Exchange DSTs

A 721 exchange, also known as an UPREIT (Umbrella Partnership Real Estate Investment Trust), is a tax-deferred transaction under IRC Section 721 in which an investor contributes property or DST interests to an Operating Partnership in exchange for units in a REIT.

A 721 exchange (also called an UPREIT transaction) allows investors to exchange their DST shares into a Real Estate Investment Trust (REIT) on a tax-deferred basis. This means you can move from a single DST property into a larger, more diversified REIT portfolio — without triggering capital gains taxes.

With a 721 exchange DST, investors first receive the benefits of a DST: tax deferral, stable income, and capital preservation. After a holding period, they can then access a more broadly diversified REIT. The REIT is structured to provide monthly income, additional growth potential, liquidity through a redemption program, and enhanced estate planning benefits.

How the 721 Exchange Process Works

The 721 exchange follows a two-step process. First, you use your 1031 exchange proceeds to invest in a DST that has a built-in 721 exchange option. You receive the same benefits as any DST investor — tax deferral, stable income, and capital preservation.

After a holding period (typically 2 to 3 years), you have the option to contribute your DST interest into the REIT's Operating Partnership. In exchange, you receive Operating Partnership (OP) units. These OP units give you access to the REIT's larger, more diversified portfolio.

DST vs. 721 Exchange: Key Differences

A standard DST investment lets you own a share of one or more specific properties. A 721 exchange DST starts the same way but adds a second phase: the ability to contribute your DST shares into a REIT. The REIT typically owns dozens or hundreds of properties across multiple asset classes and regions. This broader diversification is designed to reduce risk and provide additional liquidity through the REIT's redemption program.

The 721 exchange also preserves the step-up in basis at death. This means your heirs may be able to inherit the REIT shares and eliminate the deferred capital gains taxes entirely.

Key Benefits of 721 Exchange DSTs

Increased Return Potential from the REIT

Reinvest Dividends at a Discounted Price to Potentially Compound Returns

Access to a Growing Portfolio that May Enhance Investor Value

Retained Step-Up in Basis to Eliminate Past Capital Gains Tax for Heirs

Access to the REIT’s Monthly or Quarterly Redemption Program

Ease of Divisibility of Shares for Estate Planning Purposes

May Reduce Tax Filings Associated with Broader Diversification

Increased Diversification and Scale Intended to Reduce Risk

Salesforce Tower • San Francisco, CA • Developed by Hines

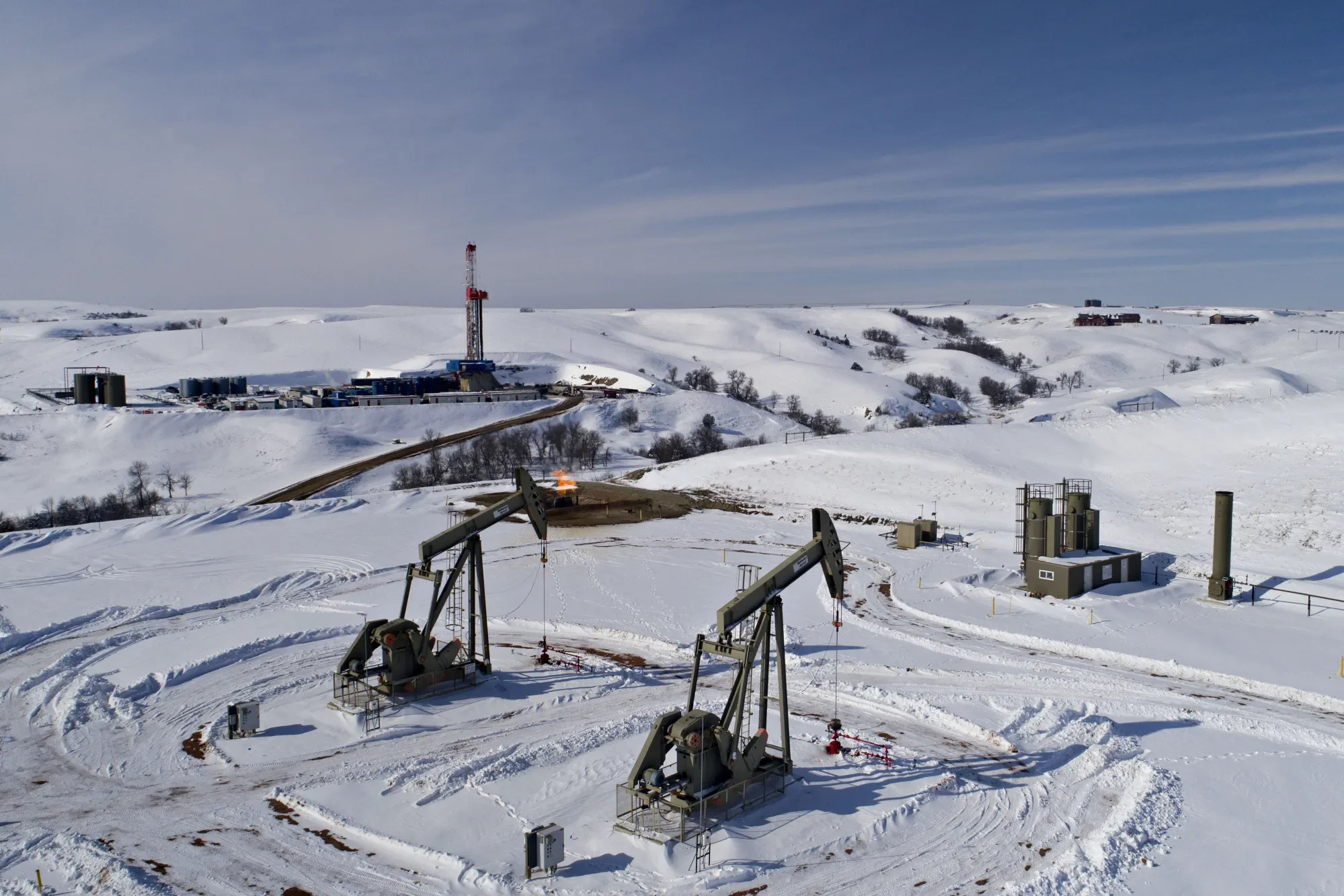

Oil & Gas Mineral Rights Investments For 1031 Exchanges

Oil and gas mineral rights are subsurface real property interests that entitle the owner to royalty payments when energy companies produce hydrocarbons from the land.

Oil and gas royalties offer a different path for 1031 exchange investors. Mineral rights are classified as real property under IRS rules. This makes them 'like-kind' to traditional real estate — and eligible for use in a 1031 exchange.

Mineral owners hold an interest in the subsurface real estate beneath a property. When energy companies drill wells and produce oil or gas, they must pay a royalty to the mineral owner. These royalties typically range from 15% to 25% of production revenue.

How Oil & Gas Royalty Income Works

When you purchase mineral rights, you become the owner of the subsurface estate beneath a piece of land. If oil and gas companies want to drill on that land, they must pay you a royalty — typically between 15% and 25% of the revenue from whatever is produced.

As the mineral owner, you are not responsible for any of the costs of drilling or operating the wells. The energy company bears all of those expenses. Your income arrives as monthly or quarterly royalty checks based on production volumes and commodity prices.

Risks and Considerations

Oil and gas royalties are tied to commodity prices and production volumes, both of which can fluctuate. If oil prices decline or wells produce less than expected, royalty income may decrease. Mineral rights are also less liquid than some other investments — selling a mineral interest can take time and requires finding a qualified buyer. As with all 1031 exchange investments, consult with your tax and legal advisors before making a decision.

Key Benefits of Oil & Gas for 1031 Exchanges

Royalties and minerals let investors step away from traditional real estate. They offer diversification into a different asset class with exposure to different economic drivers.

Royalty property owners are not locked into a shared ownership structure. Each owner controls their own holding period and exit strategy to fit their individual investment goals.

Private royalty ownership is a flexible 1031 exchange option. Whether you sell your property for $100,000 or $5,000,000, you can exchange the exact proceeds into oil and gas royalties.

Low distributions based on compressed capitalization rates have left many traditional real estate investors hungry for higher rates of return. Minerals & Royalties have the potential to experience an acceleration in cash flow caused by the drilling of additional wells by oil & gas operators.

Many traditional real estate investors are looking for higher income. Mineral rights and royalties offer the potential for increased cash flow as oil and gas companies drill new wells on the property.

Minerals and royalties can absorb any leftover exchange proceeds from the sale of your relinquished property. This helps you fully complete your 1031 exchange.

NFL Training Facility • Las Vegas, NV • Owned by Capital Square

Short-Term 1031 Exchange Solution: Customized Exchange Platform

Baker 1031 Investments' Customized Exchange Platform is a concierge investment service for high-net-worth investors with $5 million or more in 1031 exchange equity.

Our Customized Exchange Platform is designed for investors with $5 million or more in 1031 exchange equity. It provides sole-ownership investment options tailored to your specific exchange requirements. Targeted annualized cash flows range from 5.75% to 6.00%+, paid out monthly.

After 1-3 years, you are provided a no-obligation offer to acquire the asset(s) you select, with 1% appreciation per year on the value. This offer is intended to provide investors with the choice to participate in enhanced optionality, value, income, growth, liquidity, and estate planning options via a tax-deferred exchange into ExchangeRight’s REIT.

How the Customized Exchange Platform Works

The Customized Exchange Platform begins with a consultation. Our team learns about your exchange requirements, timeline, and investment preferences. We then present you with a selection of pre-vetted properties from our acquisition pipeline.

You choose the asset or assets that fit your goals. Our dedicated transaction team handles the acquisition, due diligence, and 1031 exchange coordination on your behalf. You take sole ownership of the property, backed by institutional asset management, accounting, and reporting.

After a holding period of 1 to 3 years, you receive a no-obligation offer to contribute your property into the sponsor's REIT. This offer includes 1% appreciation per year on the property value, giving you the option to access the REIT's broader portfolio, liquidity, and estate planning benefits.

Key Benefits of the Customized Exchange Platform

Select From A Pre-Vetted Acquisition Pipeline

Annualized Cash Flows of 5.75% - 6.00%+ Paid Out Monthly

Concierge Transaction and 1031 Exchange Coordination

Diversified $5.6B+ Portfolio and Aggregation Strategy

Access to the REIT’s Monthly or Quarterly Redemption Program

Enhanced Optionality and Flexibility at Exit

Institutional Asset Management, Accounting, and Reporting

Dedicated Acquisitions, Due Diligence, and Transaction Teams

Compare 1031 Exchange Investment Strategies

See how each strategy aligns with your investment goals.

| Feature | DST Properties | 721 Exchange DST | Oil & Gas | Custom Platform |

|---|---|---|---|---|

| Minimum Investment | ~$100K | ~$100K | ~$100K | $5M+ |

| Income Type | Rental Income | REIT Dividends | Royalty Income | Rental Income |

| Management | Fully Passive | Fully Passive | Fully Passive | Institutional |

| Closing Speed | 1–3 Days | 1–3 Days | Varies | Custom Timeline |

| REIT Access | Via 721 Exchange | ✓ Built-In | ✗ | Via 721 Exchange |

| Liquidity | Illiquid | REIT Redemption Program | Owner-Controlled Exit | REIT Redemption Program |

| Tax Benefits | Depreciation, Tax Deferral, Step-Up in Basis | Tax Deferral, Step-Up in Basis, REIT Tax Treatment | 15% Depletion Allowance, Tax Deferral | Depreciation, Tax Deferral, 721 Exchange to REIT |

| Ownership Type | Fractional (Beneficial Interest) | REIT Units (OP Units) | Direct Undivided Interest | Sole Ownership |

| Best For | Investors wanting passive income & simplicity | Investors wanting diversification & liquidity | Investors wanting a non-traditional asset class | High-net-worth investors wanting control & scale |

Frequently Asked Questions About 1031 Exchange Investments

Get answers to the most common questions about 1031 exchanges, DSTs, 721 exchanges, and more.

Educational Resources for 1031 Exchange Investors

-

The statement that "Nearly 30% of all experienced real estate investors " is a market share estimate derived from an analysis of third-party market data as of October 2025, representing the proportional relationship between the Baker 1031 Investment investor database and an estimated total market of active real estate investors; this estimate is based on Crexi reporting a 2,000,000 user base, 80% of whom are assumed not to be agents/brokers, and 42% of activity dedicated to investment sales, from which a conservative assumption excludes 15.7% as non-investor service providers (e.g., appraisers, lenders), resulting in an estimated active investor market of 566,664; as the Baker 1031 Investment database comprises over 170,000 individuals or entities, this figure represents 30.00% of the estimated market.

The figures and calculations provided constitute a market share estimate based on unverified third-party data and internal assumptions utilized to define the estimated market; Baker 1031 Investment has not independently verified the accuracy of the underlying data, and the term "experienced real estate investors" is defined exclusively by this methodology and its internal assumptions. This communication is not a guarantee of future results, a testimonial, or a statement of performance for any investment product or service, and its accuracy is subject to the inherent limitations of the underlying data and the validity of the internal exclusion assumptions.

The calculated platform averages presented reflect a statistical average of data provided by the specific investment sponsors listed here. The figures used in these averages are collected from self-reported statistics provided directly by the respective firms within their Private Placement Memorandums (PPMs). This information is provided solely for illustrative and educational purposes and is not intended to serve as the basis for any investment decision, nor does it constitute investment advice, a recommendation, or an offer to sell or a solicitation of an offer to buy any security.

Due to the nature of self-reporting, the data presented may be incomplete, unverified, or subject to correction, and we make no representation or warranty as to its accuracy, completeness, or timeliness. Past performance is not indicative of future results, and all investments involve risk, including the possible loss of principal. The platform average represents a limited sample, and results from individual sponsors may vary materially. For complete underlying data, data from other investment sponsors, and/or additional detail, please contact us directly. The selection of results shown are a small fraction of the total amount of realized investments and are not guarantees of future results. There are often differences between the performance results and the actual results shown and other investments' outcomes. Delaware Statutory Trust (DST) investments are subject to volatility and loss of investor principal.