Our Due Diligence Process

Our clients rely on an investment process built on our decades of experience navigating complex real estate markets. Over the years, our process has helped investors manage risks and pursue returns through every market environment.

Our Active Due Diligence Process

Powered by four key drivers, Baker 1031 Investments’ due diligence process is designed to take a 360-degree view of risks and opportunities, enabling our clients to only access the best investment opportunities.

Macro

Asset-Level

Investment Sponsor

Portfolio

Macro Review

We partner with a leading broker-dealer, Aurora Securities, to provide a thorough review of the investment offering, including checks for structural issues, high-risk elements, and investment sponsor stability.

Asset-Level Review

As real estate investment professionals, we perform our own underwriting of the real estate underlying the investment offering, independent of the investment sponsor's provided underwriting. We verify market data, reforecast financials, and perform a thorough review of the leases, third-party reports, and other due diligence items.

Sponsor Review

Through a network of credible audit firms, we perform a thorough review of the investment’s sponsor firm. This audit verifies the financial stability of the investment sponsor, reviews their past performance track record, and provides insights into the overall risk profile of the investment offering.

Portfolio Review

Even if an investment meets all of our other due diligence requirements, we take our process a step further by taking a look at the offering from the perspective of: “Does this investment opportunity meet our clients’ needs?” In other words, we determine if we believe this investment offering can be a positive addition to any of our clients’ portfolios.

Why Due Diligence Matters

For many real estate investors, moving from active to passive ownership raises one big concern: risk of loss. At Baker 1031 Investments, we understand the hard work behind your real estate portfolio.

Thanks to our strict due diligence process, our investment platform has a lower risk of loss than traditional property ownership. It also carries less risk than bonds, equities, and other alternative investments.

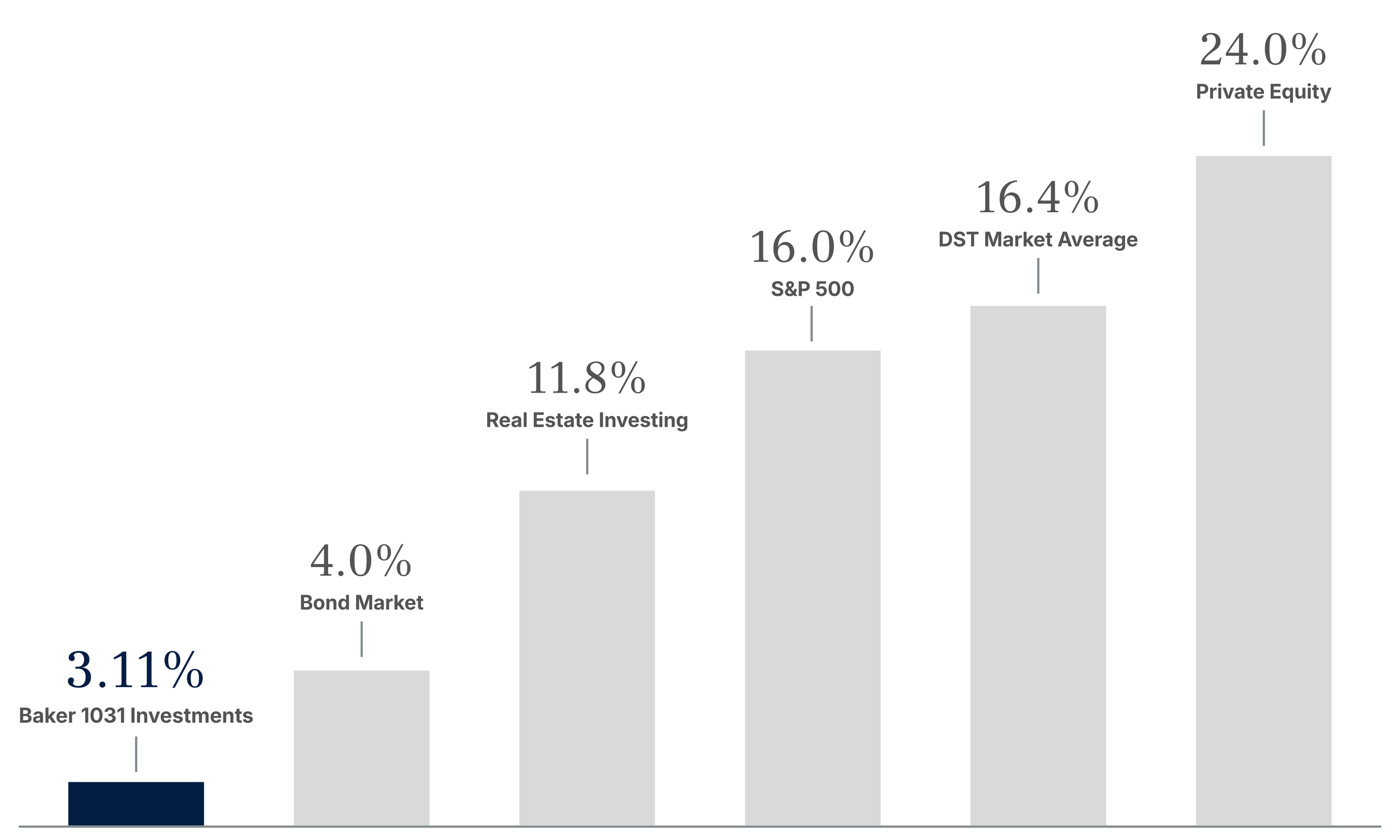

Percentage Chance of Loss by Investment Type

-

All investments contain risk and may lose value. Investors should consult their investment professional prior to making an investment decision.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.